Choose exactly where your taxes go.

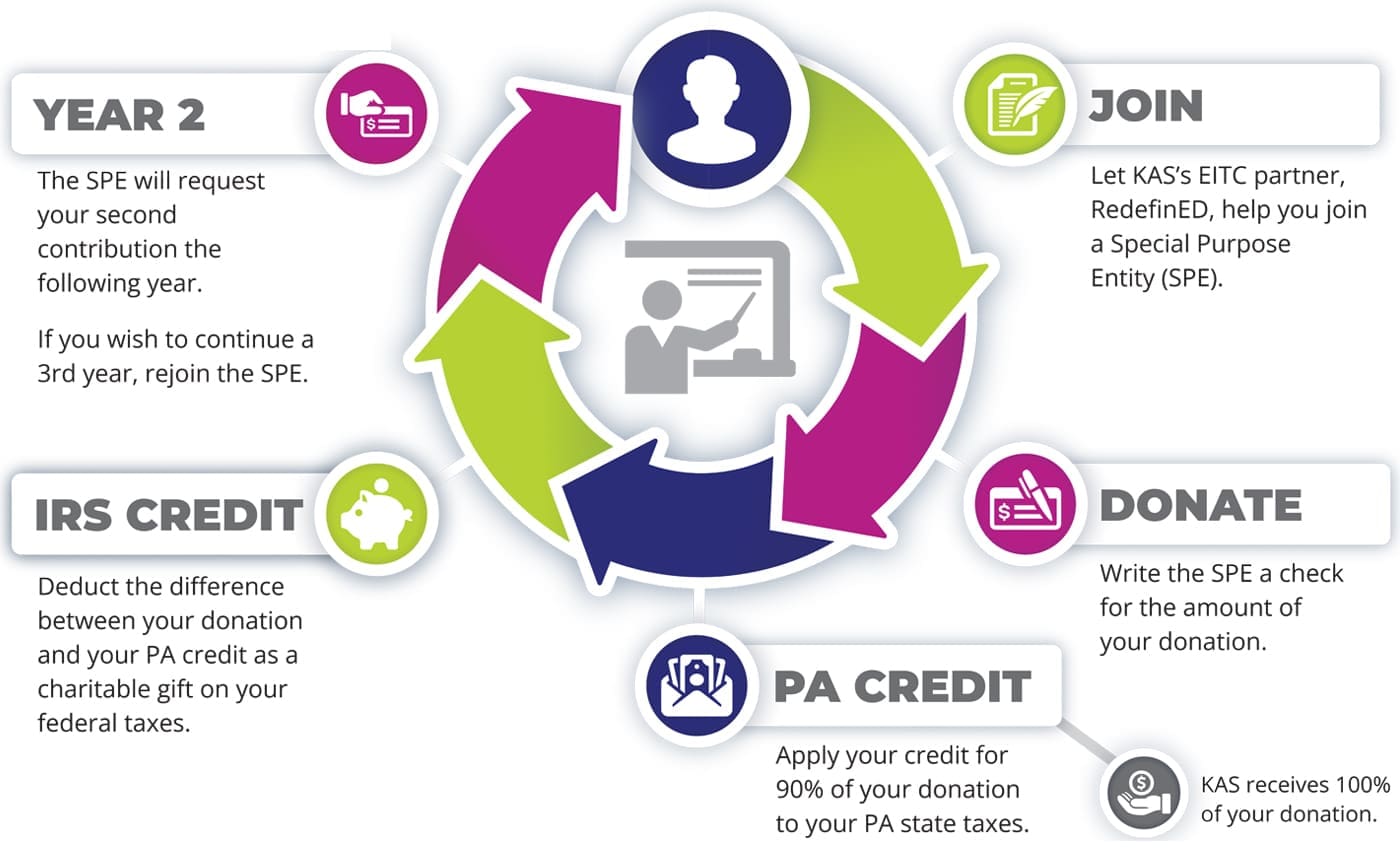

In Pennsylvania, the Educational Improvement Tax Credit (EITC) program allows you to do just that. If you pay state taxes in Pennsylvania, you can make a contribution to Kentucky Avenue School and receive 90% of that contribution back in the form of a tax credit. It costs a dime to give a dollar.

Funds from EITC go directly to our need-based financial aid program, supporting students who would otherwise not be able to afford Kentucky Avenue School. Working together with local business partners and individual donors, we can achieve truly remarkable things in our school, our community, and our city.

Why contribute?

Benefits for KAS

Your support can make a real difference in enhancing educational opportunities for all students, irrespective of their socioeconomic status or background. By contributing to the EITC program, you’re investing in the future of our community and empowering the next generation to thrive.

It’s a tangible way for the KAS community to ensure that every child has access to a KAS education. Funds from EITC go directly to our need-based financial aid program, supporting students who would otherwise not be able to afford Kentucky Avenue School. School funds, that would have gone to scholarships, are freed up to provide resources and opportunities that benefit all students.

Tax benefits for you

You can also receive substantial tax benefits. This includes a Pennsylvania tax credit of 90% of your donation for a 2-year commitment. For individuals, the remaining 10% can be a charitable donation deduction on your Federal tax return. Businesses may be able to claim even more as a deduction on your federal taxes.

Please consult with your Tax Professional before donating to understand your full benefits.

Example Individual Contribution

Taxes

PA Taxable Income

$130,000

PA Tax Liability (3.07%)

$3,991

EITC Donation

$3,900

PA Tax Credit

$3,510

Federal Charitable Deduction

$86

COST

Cash Donation

$3,900

Combined tax savings

-$3,596

Final Cost to Donor

$304

KAS receives

$3,900

Example assumes a couple Married Filing Jointly in the 22% marginal income tax bracket who elect to itemize deductions.

Quick Definitions

EITC – Educational Improvement Tax Credits are tax credits to eligible businesses and individuals contributing to fund scholarships for Pennsylvania students. More here.

SPE– Special Purpose Entity is an organization that handles much of the paperwork for individuals and businesses applying for EITC. More complete definition in the FAQ below.

How it works.

Can I participate?

Where do I join an SPE?

KAS has partnered with RedefinED to assist with our EITC efforts. RedefinED will help you join an SPE and donate to Kentucky Avenue School.

Contact our donor relationship manager, Erin Rockwell, at erin@redefiningeducation.org or 814.999.3588 to get started.

Spread the word!

Would your employer, friends, or family like to support KAS? Send them to this page, or download and print/send one of our overview sheets.

Frequently Asked Questions

Want to stay informed on EITC or learn more?

Signup for our EITC mails and we’ll notify you of deadlines, changes, and answer any questions you might have.

It really couldn’t be easier. To get started, Contact our RedefinED donor relationship manager

Erin Rockwell, at erin@redefiningeducation.org or 814.999.3588 to get started.

For additional questions, contact KAS at eitc@kentuckyavenueschool.org or 412-361-5332.